Top Guidelines Of Baron Tax & Accounting

Top Guidelines Of Baron Tax & Accounting

Blog Article

Baron Tax & Accounting for Beginners

Table of ContentsBaron Tax & Accounting Fundamentals Explained7 Easy Facts About Baron Tax & Accounting DescribedFacts About Baron Tax & Accounting RevealedLittle Known Questions About Baron Tax & Accounting.

Some small companies have easy pay-roll needs since they have a tiny group of employed employees. The majority of, nonetheless, have a mix of per hour and salaried employees and more complicated pay-roll needs that need a greater degree of knowledge. Handling pay-roll can be challenging and commonly calls for a degree of time and know-how that the majority of local business owners merely don't have.

Before this can occur, nevertheless, they need to initially reconcile the annual report accounts and analyze the operating results to guarantee that whatever is accurate. An unfavorable fact for lots of services is that clients don't constantly pay their costs on time. Attempting to gather overdue billings and make certain that you get paid for the truthful work that you gave is not an easy task to complete.

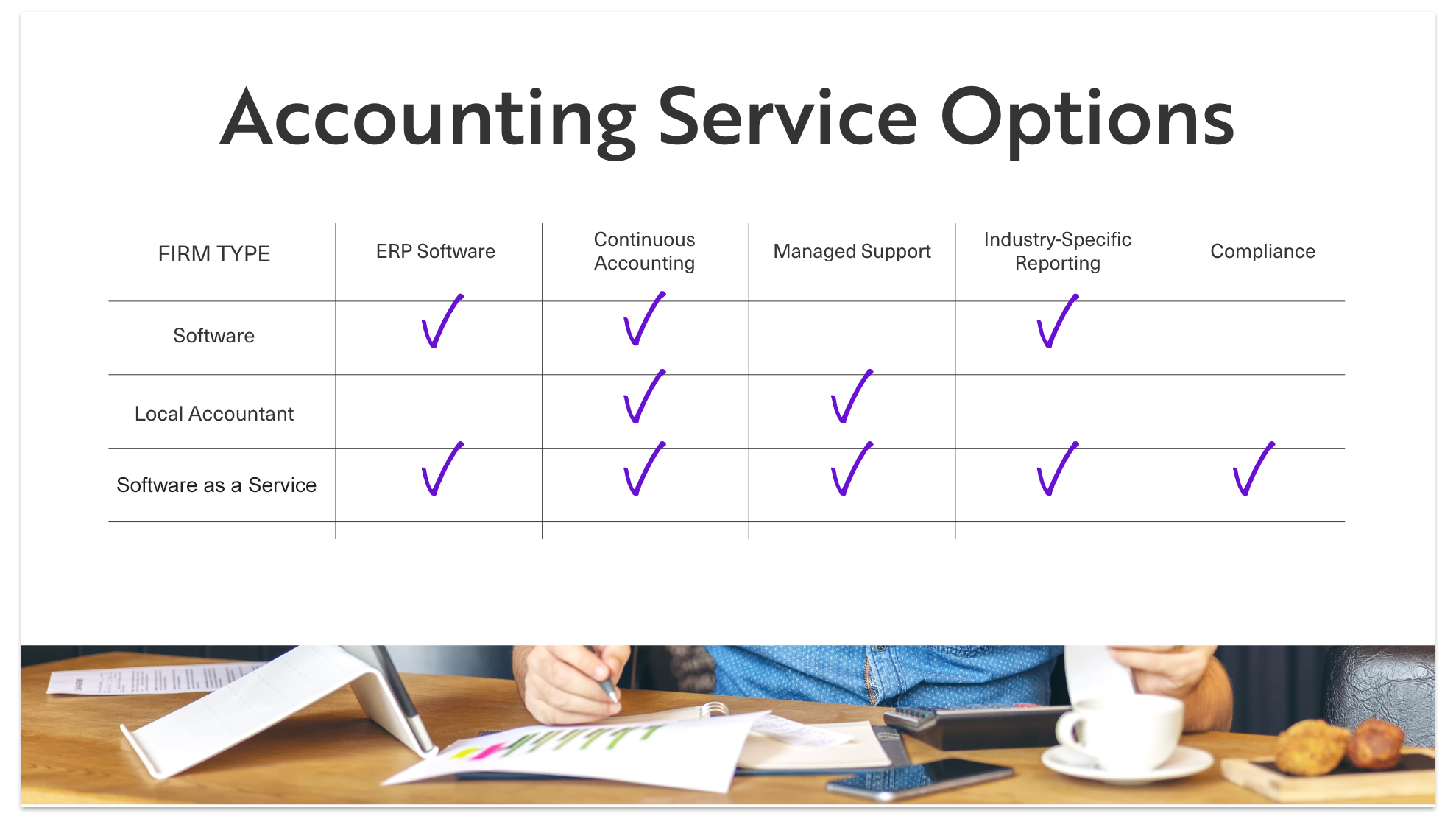

These are simply a few examples of the lots of monetary tasks that accounting professionals can remove of your plate. Whatever your distinct needs are as an organization, an accountant can aid you and can develop a customized service that fits completely. There are a few ways to tackle getting an accounting professional, and some are much better than others.

Tax obligation accounting professionals are great at what they do, however they typically aren't the very best choice when it comes to dealing with the persisting bookkeeping and month-end accounting jobs. An additional preferred remedy that lots of small companies transform to is outsourced accountancy. trusted online tax agent. With this path, you would certainly employ an outsourced accounting company or fractional accountant to manage your accountancy needs

Some Ideas on Baron Tax & Accounting You Need To Know

You can get the solutions you need without paying too much. You can also obtain accessibility to sector or subject matter knowledge when you require it. Milestone uses outsourced accounting services that are adaptable, economical, personalized, and hassle-free. We specialize in assisting small companies understand their potential and offer market experience at a fraction of the expense.

Audit encompasses a wide variety of different finance-focused solutions. While there specify sorts of accounting professionals, all accounting professionals hold the exact same basic training prior to participating in even more specialised areas for their jobs. Not all accounting professionals offer the same service. While the foundations continue to be the exact same, numerous accountants are experts past the standard plan to use their services in specific fields or industries.

Audit for non-profit companies or federal government services is considered fund or federal government accounting. Normal accountancy solutions are included, with an expertise in managing funds and public money. Forensic accounting professionals offer professional service in evaluating, reporting, and exploring existing financial resources and monetary software program. Larger accounting business might have internal forensic accountants being experts in legal locations such as fraud, insurance coverage cases and construction.

Baron Tax & Accounting Fundamentals Explained

While there are several particular niches of a specialist accountant, this covers a few of the examples of what accountants do in various duties. However, there is also plenty of variability in each book-keeping role depending on a variety of variables. One exclusive accountant may be experts in company planning and reporting, while an additional might deal with day-to-day accounts and pay-roll.

While these might vary from job to work, taking care of these essential duties is the basis for any book-keeping task across nearly any kind of industry and area of work. Past the five duties, a few weblink of the main work that an accountant will provide consist of every one of the below: While some firms may use a bookkeeper. ATO tax return help online for everyday monetary monitoring, upkeep and comparable services, others might pick to employ an accounting professional to do so

Taking care of payroll is one more timeless task that accounting professionals manage, consisting of ensuring all personnel are paid promptly, overtime is made up, and holiday and ill pay are computed correctly. An accountant may also deliver payroll reports and possibly give statistics according to the KPIs and comparable evaluations of departments or private staff members.

Baron Tax & Accounting Can Be Fun For Everyone

Coverage permits organization owners and supervisors to have quickly, accessible understanding into their present financial resources. These reports can be used for tax obligation functions as well as for business preparation and general record keeping.

However, you can't do accounting jobs on your own because of a lack of time. Back then, working with a specialist accountant would certainly help you manage your revenue and expenses. By doing this, they can additionally help you make an organization strategy and save money for future use. Accounting professionals offer info on the organization's funds, resources, expenditures, and results that the business gets from accountancy.

Report this page